The new simplified tax regime with lower tax rate is given below. If taxpayer does not want to claim any exemptions new simplified tax regime is applicable. The second tax slab is with lower tax rate. The tax slab in case exemption is claimed is given below. the tax rate with higher rate is applicable. In case individual or HUF wants to claim exemptions under 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, etc. The first tax slab is with higher tax rate. No major changes were made in income tax rules. Only change which is made in budget is senior citizen above 75 years of age is exempted for filing income tax return if they have income only from pension and interest. Income tax slabs and income tax rate will remain same for FY 2022-23 (AY 2023-24).

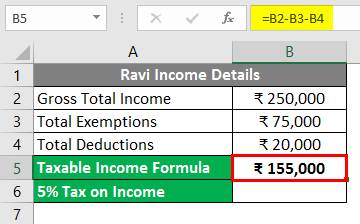

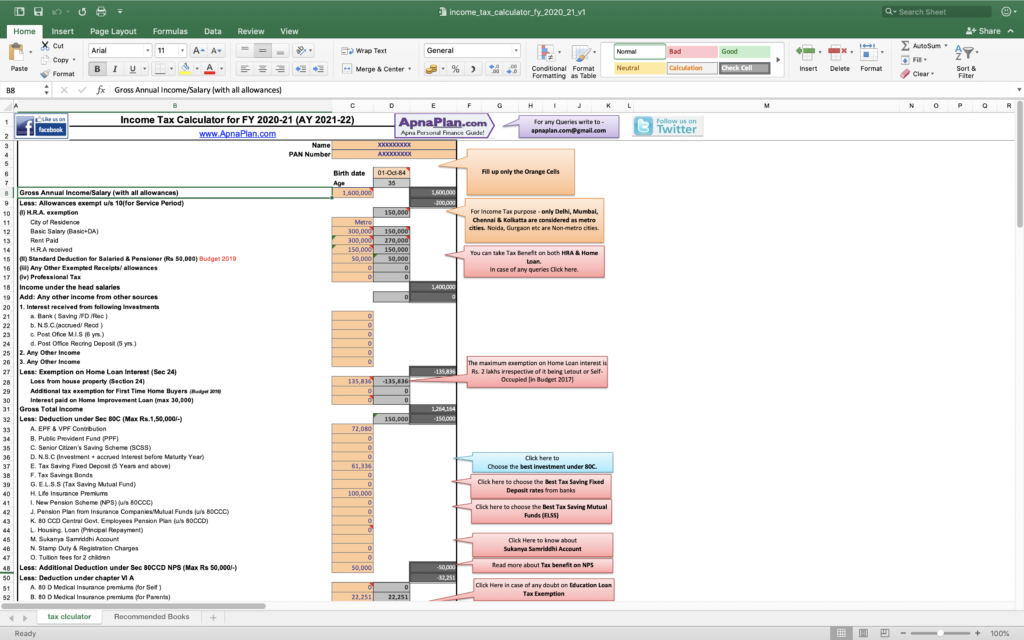

Before downloading excel based income tax calculator let’s get acquainted with Latest Income Tax Slab for FY 2021-22 and Income Tax changes made in the Budget 2022. Simple excel based formulas and functions are used in creating this calculator. The calculator is created using Microsoft excel. You can calculate your tax liability and decide tax efficient investment options and suitable tax structure for FY 2021-22. This calculator will work for both old and new tax slab rate which were released in 2020. It is simple and user-friendly income tax calculator for salaried individuals. You may well have to do some sifting to find precisely what you need.Download Income Tax Calculator FY 2021-22 (AY 2022-23) in Excel Format. The IRS website search function is useful, but as with government sites, it returns a lot of information. The IRS provides a comprehensive Tax Topic Index covering the major tax questions. Double-check local tax specifics using the FindLaw State Tax Law finder. The same is true for student loan payments and interest, and so on.Īlso, individual states have specific tax laws. If you contribute to a Roth IRA, for instance, you need to know the specific contribution limit for your tax status: IRS Roth IRA Limits. However, these only cover tax reforms and structures. As a quick example, you can use VLOOKUP to find and return values in a tax table, while you can use ISPMT to calculate the amount of interest paid on your outstanding loans.Īlso, handy for building your own income tax calculator spreadsheet is the IRS 1040 Tax and Earned Income Credit Tables.

Read more about what these Excel formulas do and how to use them properly.

0 kommentar(er)

0 kommentar(er)